Money Laundering is a Critical Issue that requires more Attention

by The Data Company, 28 March 2023

Attention Financial Institutions in South Africa!

What steps are you taking to prevent fraud and combat money laundering? Is it enough considering the recent grey-listing of South Africa?

Financial institutions today face significant challenges in detecting, preventing, and investigating financial crimes (e.g. fraud and money laundering).

The growing complexity of financial transactions, the increasing sophistication of criminal activities, and the sheer volume of data can make it difficult to identify and mitigate these risks.

This becomes more challenging considering the fact that the anti-crime processes for AML and fraud in banks have typically been established separately, resulting in unconnected data silos. On top of these basic issues, an increasing number of financial institutions want to combine anti-fraud and AML efforts.

- One of the most significant obstacles is the need to fuse together data from disparate sources. Financial institutions must deal with a variety of data structures and formats, as well as data inconsistencies and missing pieces, which can make it difficult to create a unified view of financial crime risk.

- Another challenge is the need to ensure data accuracy, completeness, and consistency. It is challenging to match entities stored in various systems where no one has considered common data naming and formatting when implementing the solutions.

- A third challenge is to create a holistic view of risk, which requires new analyses as well as the combination and synchronisation of rules and scores, for both AML and fraud.

- Finally, there is often a lack of common data governance procedures, particularly with respect to determining who has access to specific data.

In summary, preventing financial crimes such as fraud and money laundering is a significant challenge for banks and requires a comprehensive approach.

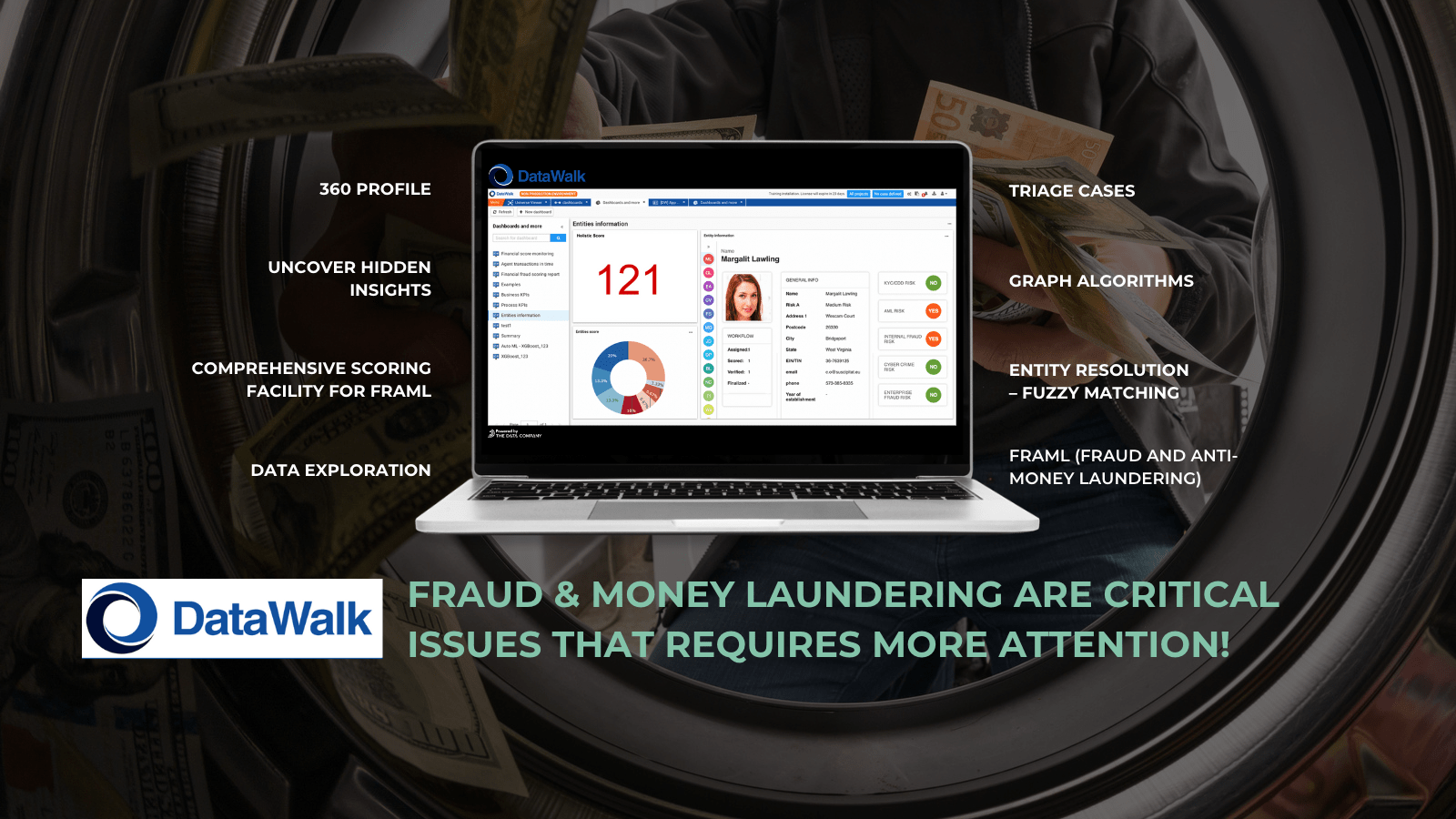

At The Data Company Technologies Ltd, we specialise in providing solutions that help you fight financial crime with greater efficiency and effectiveness using DataWalk FRAML (Fraud and Anti-Money Laundering).

By applying graph analytics to FRAML, banks can gain a more comprehensive understanding of potential risks and fraudulent activities, enabling them to develop more effective prevention and detection strategies.

Graph analytics represents a game-changer in the fight against financial crime and is an essential tool for banks to safeguard their businesses and customers from the damaging effects of fraud and money laundering.

Call us today and we’ll give you a free demo and consultation to show you how you can also stop fraud.