MiWay

CASE STUDY

Comprehensive, Affordable and Flexible Car Insurance

MiWay is a licenced non-life insurer and financial services provider, offering customers a range of non-life insurance products including motor, household, homeowners, business insurance – as well as liability cover.

Project:

Replace the existing fraud investigation tool with the DataWalk programme within a 3-month timeframe.

Project:

Replace the existing fraud investigation tool with the DataWalk programme within a 3-month timeframe.

The Challenge

- MiWay needed to expand and transform its fraud detection, analytics, triage and investigation capabilities.

- MiWay needed to replace its existing fraud investigation platform within a 3-month period.

- Platform to support MiWay in incorporating AI and predictive analytics into its fraud detection processes.

The Solution

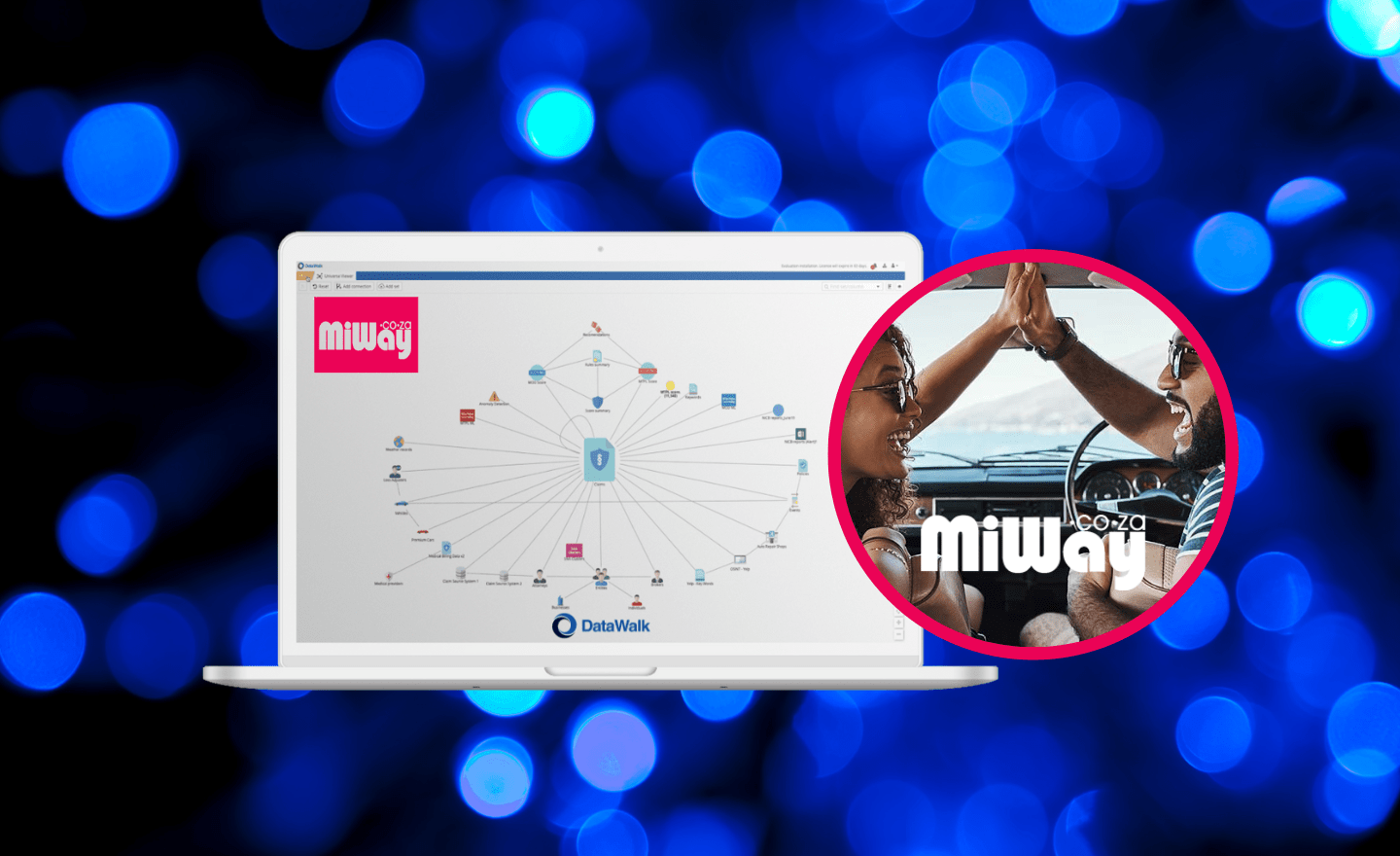

- DataWalk was implemented as MiWay’s fraud detection and forensic technology solution.

- Integration into MiWay’s data warehouse.

More on DataWalk:

Key Benefits

- 3-month implementation and go-live period.

- Significant business self-sufficiency to build own expert and fraud detection rules.

- Phase 1 incorporated the majority of all MiWay products and policies.

- Easy to use solution and significant improvement of processes.

- Improved investigation tools.

- A solid foundation of data and capabilities on which to overlay AI and predictive analytics capabilities.

- Flexible solution that can grow with MiWay as the company grows and the fraud trends evolve.